Apex fitness club uses straight line depreciation – Apex Fitness Club’s adoption of straight-line depreciation is a strategic accounting technique that warrants exploration. This article delves into the advantages and disadvantages of this depreciation method, examining its impact on the club’s financial planning and tax liability.

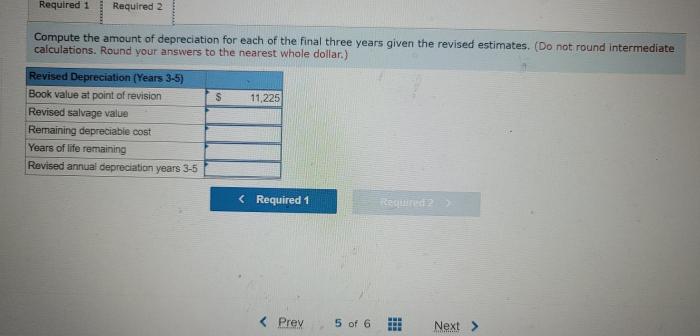

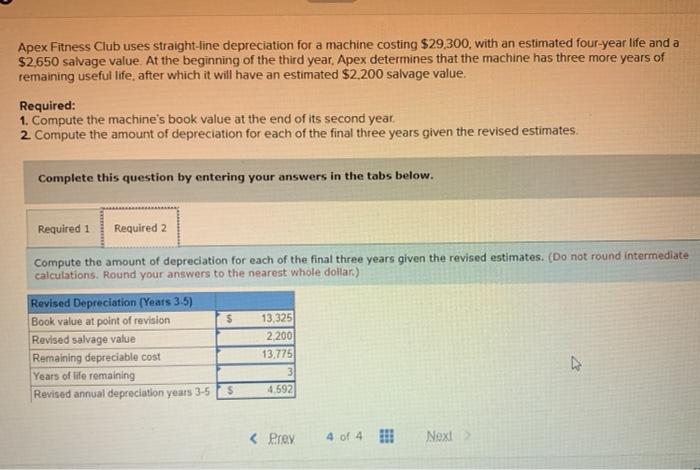

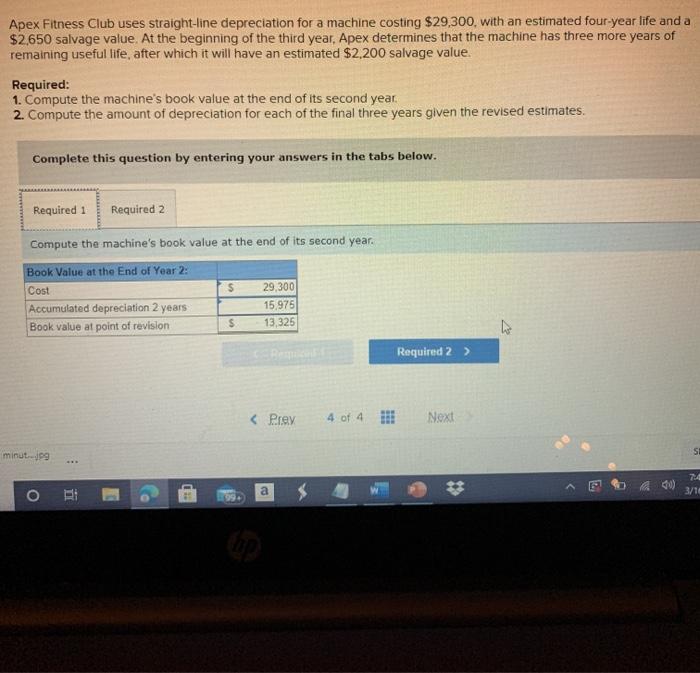

Straight-line depreciation allocates the cost of an asset evenly over its useful life, resulting in consistent depreciation expenses throughout the asset’s lifespan.

Benefits of Using Straight Line Depreciation

Apex Fitness Club can benefit from using straight line depreciation in several ways:

- Simplicity and ease of use:Straight line depreciation is a simple and straightforward method to calculate, making it easy for Apex Fitness Club to implement and manage.

- Tax planning:Straight line depreciation allows Apex Fitness Club to spread the cost of its assets over their useful lives, reducing its taxable income in the early years of ownership. This can result in tax savings and improved cash flow.

Drawbacks of Using Straight Line Depreciation: Apex Fitness Club Uses Straight Line Depreciation

While straight line depreciation offers benefits, there are also some potential drawbacks that Apex Fitness Club should consider:

- Over-depreciation of assets:Straight line depreciation may result in over-depreciation of assets, especially in the later years of their useful lives. This can lead to lower book value and reduced equity.

- Lower profits:Straight line depreciation reduces taxable income, but it also reduces reported profits. This can impact Apex Fitness Club’s financial ratios and make it more difficult to obtain financing.

Alternatives to Straight Line Depreciation

Apex Fitness Club may consider alternative depreciation methods that better suit its specific circumstances:

- Declining balance depreciation:This method accelerates depreciation in the early years of an asset’s life, resulting in higher depreciation expenses and lower taxable income. It is often used for assets that are expected to lose value quickly.

- Sum-of-the-years’-digits depreciation:This method assigns a larger portion of depreciation to the early years of an asset’s life. It is suitable for assets that generate higher revenue in the early years.

- Units-of-production depreciation:This method bases depreciation on the actual usage of an asset. It is commonly used for assets that are used in production processes.

Each alternative method has its own advantages and disadvantages, and Apex Fitness Club should carefully consider which method is most appropriate for its specific needs.

FAQ Section

What are the benefits of straight-line depreciation for Apex Fitness Club?

Straight-line depreciation simplifies accounting, provides consistent depreciation expenses, and aligns with the expected decline in asset value over time.

What are the drawbacks of straight-line depreciation for Apex Fitness Club?

Straight-line depreciation may lead to over-depreciation of assets in the early years, potentially resulting in lower profits and reduced tax savings.